投资要点:

从明年产能置换的主要省份山西、内蒙古的情况来看,虽然明年会有大量产能被淘汰,但同时新增产能也将逐渐达产。 从数量上看,将会以净新增的形式出现,而且新旧产能的替代可能存在一定的时间滞后,但从目前全国产能过剩的情况来看,预计对企业影响不大。整体市场。 焦化产能对市场的影响有所减弱。

明确煤炭增产保供政策至少持续到明年一季度。 在当前国际能源形势下,保供政策延续将是大概率事件,且随着核电新增产能逐步达产,预计2023年煤炭产量将继续呈现同比增长趋势。 但值得注意的是,虽然今年安全检查力度有所减弱,但越来越多的煤矿出现开采连续性紧张的情况,安全形势日益严峻。 这将是明年最大的风险因素。 如果发生重大安全事故,供应与安全保障的平衡可能会发生转移,从而对煤炭产量释放产生影响。

近期,房地产利好政策频出,从“保交付”到“保项目”再到“保房企”。 结合一系列金融政策的出台,市场信心得到一定提振。 从目前情况看,主要不利因素是疫情扰乱下实际消费需求的恢复。

粗钢削减政策和房地产政策的复苏仍将是影响明年需求的重要因素。 如果钢厂利润不能很好恢复,焦煤将继续处于需求负反馈的阴影之下。

1、2022年双光市场回顾

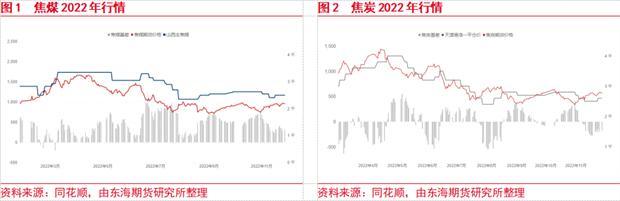

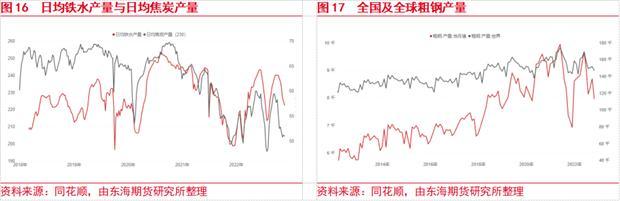

2022年初,焦炭现货价格终于结束了去年底以来的持续下跌,在原料焦煤成本支撑下开始上涨。 但炼焦煤也挤压了焦炭的利润,焦炭企业并没有盈利。 焦煤供应紧张的主要原因是山西突发煤矿事故。 年底,各大矿山都完成了年度生产目标,不少工人也回到家乡过年。 下游方面,受粗钢减产政策和秋冬环保限产影响,去年日均铁水产量跌破200万吨。 一月份的目标有所放松。 钢厂高炉逐步恢复运营。 受焦炭成本和需求的支撑,铁水产量反弹。 接下来,1月份又实施了三轮加息。

2月,秋冬环保政策叠加冬奥会。 黑色产业链上下游均限产,焦炭企业在供需两旺的情况下被动接受两轮增减。 冬奥会后,多地逐步解除重污染防治措施,北方多地高炉恢复生产。 在强烈预期带动下,焦炭市场强劲上涨,创近4月份新高。

进入金银银传统季节性旺季,两会及秋冬环保限产已告结束。 政策约束消除后,下游钢厂复工积极性更高。 在需求复苏的强烈预期下,钢厂对焦炭价格上涨的接受度较高。 2月底至4月底,焦炭价格已出现六轮上涨。 钢厂利润受到严重侵蚀,钢焦博弈进入白热化阶段。 4月初,疫情在北方主产区暴发。 省内外都实施了高速公路限制。 可口可乐的上下游物流并不顺畅。 焦煤、焦炭在生产端积压,无法运出。 钢厂原材料库存供不应求,进一步推动焦炭价格上涨。 快速着陆。

5月1日起煤炭进口关税降至零,策克口岸关闭7个月后于5月25日恢复通关。 国家增加煤炭进口的政策倾向明显,焦煤进口也在政策支持下开始企稳。 捡起。 由于市场对煤炭供应量增长有预期,加之梅雨期间季节性淡季,下游钢厂控制焦炭到货,压低焦炭价格。 5月份,四轮焦炭增减全部实施。

经历连续上涨和下跌后,焦炭基本跌至底部,引发贸易商入市抄底,焦炭库存被淘汰。 随着市场情绪的好转,6月份焦炭两轮涨幅回落。 但此时南方多地出现大雨,加上华东地区梅雨季节,下游开工不及预期。 由于强烈预期与较弱现实预期之间的差异,市场情绪迅速降温。 可口可乐经过两轮上涨后进入持续下行通道。

6月16日,随着美联储加息75bp,全球贸易经济衰退预期,工业品板块集体下跌。 3月29日213万吨。整个7月,焦炭持续笼罩在需求负反馈的阴影之下。 上个月还存在分歧的市场心态在残酷的现实面前逐渐达成共识,跌至冰点。 与此同时,保障煤炭供应效果超预期,炼焦煤产量和进口量稳步增长,炼焦煤也进入下降通道。 成本崩盘、需求疲软,焦炭主力合约一度跌至2649.5元/吨,创近一年来新低。

8月北方极端天气频发。 内蒙古、山西等地遭遇大暴雨。 气象部门发布预警后,要求煤矿停产、疏散。 8月份原煤产量大幅萎缩,煤炭价格小幅上涨。 在经历了前期的连续涨跌之后,焦炭企业普遍陷入亏损。 多家焦炭企业主动限产高达50%。 焦炭受供应萎缩和成本支撑,经历两轮上涨,焦炭企业利润得到一定程度恢复。

进入金九银十传统旺季,随着国家一系列稳定经济政策的实施,下游需求有所恢复,铁水日均产量稳步回升,焦炭也开始随着需求量的增加而增加。真实需求的支撑。 尽管终端需求形势有所好转,但钢厂却一直面临价格无利可图的局面,利润持续低迷甚至亏损。 由此带来的负反馈也传导至上游,焦煤、焦炭增长空间有限。 进入10月,随着国庆节和重要会议的召开,部分煤矿停产,引发市场对煤炭供应收缩的预期。 但与去年相比,煤矿复工速度超出市场预期,焦煤市场存在强预期与弱现实之间的差距。 迅速下跌。 可口可乐失去成本支撑,自11月份以来进入持续改善和下降通道。 焦炭企业损失严重。

2、焦炭供应情况

2.1. 焦化产能

继2020年焦化集中去产能、2021年新增产能逐步达标后,今年主要是逐步替代一批4.3米落后产能。 与往年相比,幅度较小,更换时间也较为分散。 总体而言,该声明对市场影响不大。 截至2022年10月28日,我的钢铁调查统计显示,2022年已淘汰焦化产能940万吨,新增3168万吨,净增2228万吨; 预计2022年全年淘汰2804万吨,新增淘汰5328万吨,净增2524万吨。 全国冶金焦产能55934万吨,其中4.3米及以下高度炭化室产能约11684万吨,5.5米及以上炭化室产能约44310万吨。

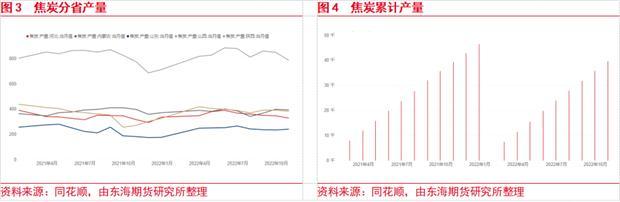

国家统计局最新公布的数据显示,今年1-10月,全国焦炭产量39684.5万吨,同比增长0.1%。 产量排名前五的省份仍然是山西、陕西、内蒙古、河北和山东,占全国产量的10%。 比例分别为21%、10%、9.7%、8.9%和6.1%。

在产能活跃的主要焦炭生产省份中,山西、内蒙古4.3米及以下焦炉数量最多,也成为近两年产能置换的重点省份。 7月23日,山西省政府办公厅印发《关于促进焦化行业高质量发展的意见》,提出分批关停退出4.3米焦炉。 ,新项目建成达产后关停,2023年底前全部关停; 2023年底前全部关停未“大小”的4.3米焦炉。科学调控焦化产能和焦炭产量,实行焦化产能总量控制制度。 全省焦化产能总量控制在14372.4万吨以内,不再新增焦化产能。 从文件中可以看出,2023年将是山西关停4.3米焦炉的重要时机。 从今年的情况来看,一些计划淘汰的焦炉甚至因长期亏损而主动提前关停,环保政策的趋势叠加。 严总预计,山西淘汰4.3米的计划明年大概率会严格执行。

据钢联10月份统计,山西4.3米焦炉在产产能3086万吨。 相关公司已逐步取消计划。 到2023年底,预计淘汰2586万吨,新增4860万吨。 到2025年底,将全部淘汰。 预计2025年总计新增5175万吨。

内蒙古作为焦化大省,焦化产能约占全国总产能的十分之一。 焦炭产量常年位居全国前三名。 也是除山西省外4.3米及以下焦炉比例最大的省份。 据钢联调查,目前内蒙古有32家主要生产冶金焦的焦炭企业,拥有焦炉101座,设计产能5880万吨,其中4.3米焦炉27座,设计产能5880万吨。总产能1340万吨,5.5米焦炉44座,总产能2380吨。 万吨,28座6.25米焦炉总产能1900万吨,2座7.36米焦炉总产能260万吨。

11月9日,乌海市焦化行业重组升级高质量发展领导小组办公室印发《乌海市焦化行业2022年至2024年有序关停淘汰企业名单》。 这是继2021年3月内蒙古自治区工业和信息化厅印发《内蒙古新业建工字(2021)85号》和《关于印发淘汰落后化解过剩产能方案的通知》后内蒙古发布产能报告 最新文件更换。 文件显示,将于2023年6月底和12月分别关停淘汰总产能725万吨的4.3米焦炉22座和总产能292万吨的5.5米焦炉6座。 这意味着钢结构 煤,预计将有1017万吨被计划淘汰。 更多淘汰产能将分布在明年上半年,全年淘汰产能占内蒙古目前总产能5880的17%。 单从淘汰量来看,似乎会对地区焦炭供应造成一定扰动。 但与此同时,十余家焦炭企业将陆续投产新产能生产焦炭。 如果明年全部达产,根据钢联的预计,明年内蒙古整体产能将出现净增长。

2.2. 主动和被动约束

从外部因素来看,焦化供给端较大的扰动是环保督查和以“钢定焦”为代表的需求导向政策。 “双碳”背景下,节能减排和环保督查成为政策重点。 焦化行业作为高耗能行业,环保督查趋于常态化,将成为制约焦炭产量释放的主要因素。 近日,国务院印发“十四五”节能减排综合工作方案,提出推进钢铁、水泥、焦化行业和燃煤锅炉超低排放改造。 目前,河北、河南、广东、广西、江西等14个省份已跟进出台“十四五”节能减排综合工作方案。 综合起来,推动了焦化行业全流程超低排放改造,促进了行业高质量发展。 制定并继续改善环境空气质量的计划。 今年,由于多地疫情影响,环保检查频次有所减少,但明年仍存在一定的不确定性。

山东一直是“钢基焦化”的代表省份。 8月12日,山东省工业和信息化厅提出,严格控制全年粗钢产量7600.3万吨以内,焦炭产量严格控制在3200万吨左右。 预计进展顺利。 任务已经完成。 从往年情况看,明年山东“定焦用钢”政策大概率会继续实施。 可以预见,环保督查、焦炭按需限产、节能减排等政策约束将是影响明年焦炭供应的外部扰动因素。

随着外部约束的减弱,对焦化供应影响最大的因素是焦化利润的活跃因素,而今年的情况就是一个典型代表。 今年虽然偶有环保限产政策,但当时焦化利润处于较低水平,大部分焦化企业已经主动限产。 当产能利用率较低时,外部约束的影响似乎很小。 一旦焦化利润回到盈亏平衡线上方,虽然利润不高,但焦化企业仍会更有动力生产、增产,从而限制产量,进一步提高焦化利润。 焦化行业长期处于中游,行业集中度不高。 如果明年外部焦炭供应没有受到限制钢结构 煤,预计焦化利润将继续维持在较低水平,焦炭产量和焦化利润将呈现动态平衡。

3、炼焦煤供应情况

3.1. 煤矿生产能力

中国的能源结构是“富煤、贫油、少气”。 我国煤炭资源探明储量居世界第四位,但优质炼焦煤资源稀缺。 据国土资源部统计,截至2016年底,全国焦煤探明资源量3073亿吨,占世界焦煤资源量的23%,占全国煤炭探明储量的19%。 其中,炼焦煤经济可采储量仅为395亿吨,仅占已查明炼焦煤资源储量的12.85%。 在已查明的3073亿吨炼焦煤资源中,气煤(不含气脂煤和1/3焦煤)为1405.3亿吨,占已查明资源量的46%,而焦煤、脂煤和1/3焦煤则占已查明资源量的46%。瘦煤仅占24%、13%和16%,高粘结性肥煤和炼焦煤短缺。

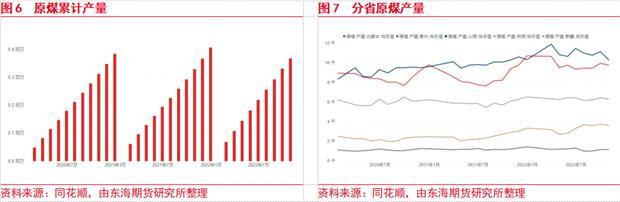

今年1-10月,我国累计原煤产量368539万吨,同比增长11.8%。 原煤日均产量保持在1200万吨以上,达到了国家发改委年初确定的目标。 10月份原煤产量37009.5万吨,同比增长1.2%。 虽然有增长,但增速却创一年来新低。 过去一年的月平均增长率为11%。 10月份原煤日均产量1194万吨,未达到国家要求。 主要原因是10月份有很多令人不安的因素,比如全国疫情暴发、国庆节、重要会议召开等。 煤矿不同程度停产、限产。 虽然他们及时复工,但与全年高强度的供应保障相比,情况仍然对煤炭供应造成一定影响。

国家能源局在四季度新闻发布会上表示,从重点产煤地区看,山西、陕西、内蒙古煤炭新增产量占全国的80.9%,对产量增长的贡献率达90.5%,充分发挥发挥煤炭大省的作用。 。 从国家统计局省级数据看,今年前10个月,山西省累计原煤产量106920.6万吨,同比增长8.8%; 内蒙古累计原煤产量96971.8万吨,同比增长16.5%; 陕西累计原煤产量61646.3万吨,同比增长7.2%; 新疆累计原煤产量32732.7万吨,同比增长34.8%。 可见,虽然山西、陕西、内蒙古三大主产区在绝对值上仍遥遥领先,但今年新疆煤炭产量大幅增长,发展潜力巨大。

新增产能方面,国家发改委3月18日发布《关于成立促进煤炭生产供应增加专项工作组的通知》,要求主要产煤省份和中央企业充分挖掘煤炭产能。挖潜增能增供给,年内释放3个煤炭产能。 超过1亿吨,其中1.5亿吨来自新投产煤矿,另外1.5亿吨的增量是通过产能增加、停产煤矿恢复生产等方式实现的。国家能源局表示11月14日,今年以来,累计核准煤矿项目14个(含调整建设规模),新增产能超过6200万吨/年,煤矿产能推动进入联合试运行、试生产约9000万吨/年。 从数据对比可以看出,实际核增产能距离原定目标还有很大差距。 煤矿核增程序复杂,涉及多部门合作。 短期内难以大量增加核容量。 预计明年将逐步推出。

山西、陕西等传统产煤省份经历了多年的开采和复杂的地质条件,增长空间极其有限。 今年以来,山西在稳定现有煤炭产量的基础上,推动64个煤矿核增产3860万吨/年。 9个在建煤矿进入联合试运行,年新增产能960万吨。 内蒙古、新疆地质条件相对优越,以露天矿为主。 它们也成为核电产能提升的重点领域。 据内蒙古日报报道,今年以来,鄂尔多斯市全力挖潜增产。 新增煤矿复产46个,新增产能9570万吨/年。 加快煤矿各项手续办理,积极争取煤矿产能提升。 累计批准新增产能87个煤矿,每年新增产能1.21亿吨。 国家能源集团新疆公司是新疆最大的煤炭公司。 6月13日,国家发展改革委确定了符合安全新增产能条件的煤矿名单。 其中,国家能源集团新疆公司煤矿每年新增煤炭总量2200万吨。

3.2. 安全与供应保障的平衡

从明年的生产计划来看,山西省已明确了2023年的生产目标。6月20日,山西省政府印发了《山西省煤炭增产保供应增产能工作方案》。 规划提出2022年煤炭产量目标为13亿吨,力争2023年煤炭产量比2022年增加5000万吨,达到每年13.5亿吨。 目前,省级目标已分解到产煤地级市,今年目标正在按计划完成。 预计明年13.5亿吨的目标大概率实现。 国家层面,8月,国家能源局落实国务院部署,与各产煤省区共同签署煤炭安全供应责任书,明确2022年至2023年煤炭产能和日均产量任务,确保各省区完成生产转移 根据生产情况实施政策激励或约束,确保全国日均产量达到1200万吨以上,力争达到1250万吨以上。 供应保障计划将至少延长至明年3月。 在国际能源形势紧张的情况下,可以预见,明年煤矿增产保持续供应将是大概率事件。

煤矿增产保供政策实施以来,全国煤炭生产从去年的“阶段性保供”逐步进入目前的“常态化保供”。 增产保供任务艰巨。 煤矿持续高压生产,安全检查时间缩短。 采矿连续性紧张现象容易发生,为重大安全事故埋下隐患。 据中国煤炭报报道,我国目前已查明连续开采严重的煤矿367个,涉及山西、内蒙古、新疆等22个省(自治区)。 今年安全事故也频发。 据《山西日报》报道,截至目前,今年山西省煤矿共发生死亡事故52起,造成62人死亡。 与去年相比,事故起数增加136%,死亡人数增加148%。 今年不少国家级示范矿井也发生事故,可见保障供应压力之大。

综合来看,煤炭增产保供政策至少持续到明年一季度。 在当前国际能源形势下,保供政策延续将是大概率事件。 并且随着核电新增产能逐步达产,2023年煤炭产量预计将继续呈现同比增长。 但值得注意的是,今年虽然安全检查力度有所减弱,但越来越多的煤矿出现开采连续性紧张的情况,安全形势日益严峻。 这将是明年最大的风险因素。 如果发生重大安全事故,供应与安全保障的平衡可能会发生转移,从而对煤炭产量释放产生影响。

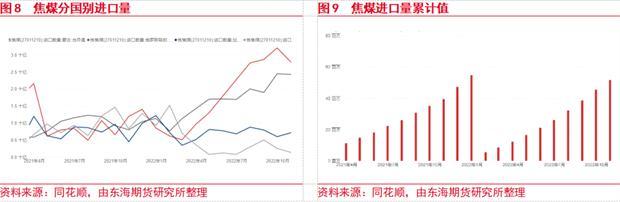

4.炼焦煤、焦炭进出口

海关总署数据显示,今年1-10月我国炼焦煤累计进口货值5164.1万吨,同比增长30.8%。 蒙古和俄罗斯仍然是最大的进口来源国,其中蒙古煤炭占37%,俄罗斯占33%。 其中,加拿大占13%,美国占8%。 10月份我国炼焦煤进口620.8万吨,同比增长41.6%,环比下降9.3%。 此后,焦煤结束了连续7个月环比正增长。 10月份进口量下降的主要原因是北方地区疫情以及甘其毛都口岸国庆期间放假。 预计11月和12月进口量将逐步回升。

4月28日,国务院关税税则委员会发布关于调整煤炭进口关税的公告。 2022年5月1日至2023年3月31日,煤炭进口暂定税率为零。 在今年紧张的国际能源形势下,加拿大和美国的煤炭价格与国内煤炭价格呈负相关。 零关税对促进这两个国家煤炭进口的作用相对较小。 政策实施后,这两个国家的炼焦煤进口量甚至不升反降。

零关税政策对俄罗斯煤炭、蒙古煤炭起到了锦上添花的作用。 政策实施后,自俄罗斯、蒙古国炼焦煤进口大幅增加,成为我国最重要的炼焦煤进口国。 两项数据加起来占进口总量的80%以上。 。 零关税政策实施后,蒙古超越俄罗斯,再次成为我国最大炼焦煤进口国。 已连续六个月位居第一。 可以说,蒙古煤炭进口的任何风波都将直接影响我国炼焦煤的进口总量。 除了进口关税政策的促进作用外,蒙古国本身也有增加出口收入的动力。 近年来,国际煤炭价格飙升,基础原材料出口占蒙古国内生产总值的比重非常高。 蒙古政府官员表示,蒙古86%的出口产品销往中国,其中煤炭占一半以上。 In order to increase foreign exchange reserves, the Mongolian government has assigned the task to the ETT Company to increase revenue for six months starting from October 26, 2022. Once the plan was launched, the coal transportation volume from Tavan Tolgoi Coal Mine to Chaganhada skyrocketed, which was also the direct driving factor for the recent increase in Mongolian coal imports. As of November 7, Ganqimaodu Port has imported a total of 13.1032 million tons of coal, a year-on-year increase of 149.44%. The current average daily customs clearance vehicles in Ganqimaodu has remained above 800 vehicles, which greatly exceeded the market expectation of 700 vehicles. 这很好。 It is expected that vehicles passing through Ganqimaodu will return to pre-epidemic levels next year.

On the other hand, Ceke Port resumed customs clearance on May 25 after being closed for seven months. Last year, nearly one-third of Mongolian coal was imported through Ceke Port. This year's customs clearance also played a role in the increase in Mongolian coal imports. Important addition: However, due to the impact of the epidemic since September, the external shunting of Ceke Port has been in an abnormal state and has not reached the previous level. Compared with the impact of the epidemic on Mongolian coal imports in the past two years, as the epidemic prevention policies gradually mature this year, the impact of the epidemic is weakening at the margin. Coupled with the opening of multiple railways in Mongolia this year, infrastructure being gradually improved, and projects under construction, Mongolian officials said that Mongolia's coal exports may reach 70 million tons per year by 2025.

Since the outbreak of the Russia-Ukraine conflict, Russian energy has been subject to sanctions in the international market. In addition, settlement issues caused by economic sanctions have worried Russian coal importers. Russian coking coal has appeared in excess in the international market. After Chinese buyers actively explored RMB settlement methods, , absorbing a large amount of cost-effective Russian coal. As the temperature has dropped recently, there have been certain restrictions on the sea transportation of Russian coal. In addition, the increase in trade between the two countries this year has caused port congestion, which has also affected Russian coal imports.

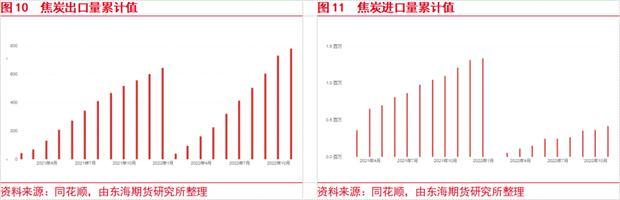

In terms of coke import and export, data from the General Administration of Customs show that China's cumulative coke import volume from January to October was 416,000 tons, a year-on-year decrease of 793,000 tons, a year-on-year decrease of 66%. Coke export volume from January to October was 7.816 million tons, an increase of 40% over the same period last year. Part of the reason for the growth in exports is the tense international energy situation, high international coke prices, huge profits from coke exports, and strong export enthusiasm among traders. Coupled with long-term sluggish domestic coke profits and poor sales, coke exports have become a supplementary channel for some enterprises. A large part of my country's coke exports to India this year. The Indian government implemented a zero-tariff import policy for coking coal and coke on May 22, which will benefit my country's coke exports this year. India has recently restored tariffs, which is expected to have a certain impact on coke exports. Overall, China's coke is self-sufficient, and imported and exported coke account for a small proportion of domestic supply and demand. Data from the General Administration of Customs show that in 2021, China imported 1.33 million tons of coke and exported 6.44 million tons of coke. Among them, the amount of imported coke accounted for only 0.29% of China's coke production last year, and the amount of exported coke accounted for 1.4% of China's coke production.

5. Downstream demand situation

In the first quarter of this year, under the constraints of external factors such as autumn and winter production restrictions, the Winter Olympics, and the Two Sessions, blast furnace production was restricted in many places, and the average daily hot metal production remained low. The outbreak of the epidemic in March and April affected upstream and downstream logistics and transportation. The pace of steel plant replenishment was disrupted, and terminal demand was also affected by the epidemic and failed to materialize as expected. The epidemic has been basically controlled in May and June, and the resumption of work and production is progressing steadily. The country has actively issued a number of policies to stabilize growth and promote the economy, and the market mentality has been boosted. Against the backdrop of an improving economic environment, coke demand will be supported, with daily average The output of molten iron has also climbed to this year's high of 2.4336 million tons. Later, as the Federal Reserve raised interest rates, global trading economic recession was expected, the demand for industrial products shrank, funds entered a tightening cycle, and the average daily hot metal production also continued to decline under the drag of the global economy. Domestically, the real estate market has continued to slump since the second half of last year. This year, it has been difficult to deliver pre-sold houses on time in many places, which has taken a certain hit to consumer confidence.

Against the background of a weak macroeconomic environment, it is difficult for steel products profits to improve this year. Even during the traditional peak seasons of Gold, September and Silver, when sales pick up, they only remain at a low level, which is different from last year. Steel mills have limited funds and frequently seek profit margins upstream. As a result, coking profits have remained below the break-even line for most of this year. The few profitable coking companies are mainly supported by chemical products. As the most upstream of the industrial chain and with high industry concentration, coking coal's profit situation is relatively good, but negative demand feedback from downstream still limits its room for growth.

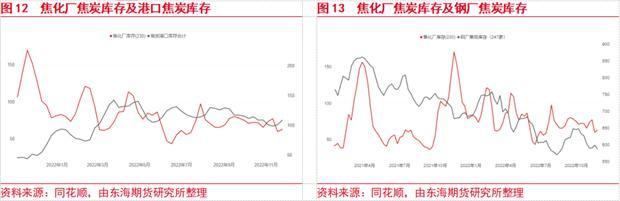

Suppressed by sluggish terminal demand and low profits, steel mills are not very enthusiastic about replenishing inventories, and have basically maintained a state of active destocking throughout the year. According to the research data of the Steel Federation, the highest coke inventory of 247 steel mills this year was on February 25. 7.57 million tons per day, while the highest level last year was 8.61 million tons. Coking coal inventories also show a similar situation of active downstream destocking. The high of coking coal inventories in 230 independent coking plants this year was 13.96 million tons on January 28, and then continued to decline. In the same period last year, coking coal inventories were 19.42 million tons. Port inventories also show a similar situation. Traders only enter the market to take goods when prices fall to the bottom, and port inventories remain destocked throughout the year. Downstream inventory is low, followed by the initiative to lower prices in the upstream under the low inventory strategy. Steel plants maintain rigid inventories of coke, and coking plants maintain rigid inventories of coking coal. The transmission to the upstream is the low profit situation of coking coal and coke this year.

On April 19, the National Development and Reform Commission stated that in 2022, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Ecology and Environment, and the National Bureau of Statistics will continue to carry out the national crude steel production reduction work to ensure that the national crude steel production decreases year-on-year. 。 Crude steel reduction has once again become the focus of this year's policy. Since the crude steel reduction policy began to be implemented in the second half of last year, the policy has been extremely strong. The daily average hot metal production has continued to decline, and the direct demand for coke has been significantly affected. National crude steel production in 2021 will be 1.035 billion tons, a year-on-year decrease of 2.8%, reducing crude steel production by 30 million tons. Although it is difficult to reflect the intensity of the crude steel reduction policy this year against the background of sluggish demand, it is foreseeable that under the background of dual carbon, the crude steel reduction policy will most likely continue next year and become an important way to macro-control steel production. 。

Statistics from the Bureau of Statistics show that from January to October this year, national crude steel production was 860.569 million tons, compared with 877.046 million tons in the same period last year, a year-on-year decrease of 1.8%. Global crude steel production has continued to decline since the Federal Reserve raised interest rates. World Steel Association data shows that global crude steel production from January to October 2022 totaled 1.5527 billion tons, a year-on-year decrease of 3.9%. Except for India, other major Asian steel countries have experienced varying degrees of decline. Recently, favorable policies for real estate have been released frequently, from "guaranteing the delivery of buildings" to "guaranteing projects" to "guaranteing housing enterprises". In conjunction with the introduction of a series of financial policies, market confidence has been boosted to a certain extent. Judging from the current situation, the major disadvantages are The determining factor lies in the recovery of real consumer demand amid the disruption of the epidemic.

Taken together, in terms of coking coal supply, it is expected that the increase in domestic production and supply will continue next year, and the import volume will steadily improve. The structural supply shortage of coking coal has been alleviated, and the cost support for coke has also weakened accordingly. We need to pay attention to the continuous supply guarantee state. The accumulation of production safety risks. In terms of coke supply, this year's coking production capacity is mainly replaced. There is a supply shortage caused by small-scale production capacity reduction in the region, but the overall impact is not significant. The external factor that will cause greater disturbance to coke supply next year may be environmental protection. Coke's own contradictions have been relatively weakened, and demand will continue to dominate next year, and profits are expected to remain in a low-level range with a high probability. On the demand side, the global economy is still in an interest rate hike cycle, and the capital crunch has had a certain impact on global demand for industrial products. Although domestic growth is relatively resilient, it cannot be immune. The crude steel reduction policy and the recovery of the real estate policy will still be an important factor affecting demand next year. If the profits of steel mills cannot be recovered well, coking coal will continue to be under the shadow of negative demand feedback.

风险提示

本报告中的信息来源于公开信息。 Our company does not guarantee the accuracy and completeness of this information. Under any circumstances, this report does not constitute a buying or selling recommendation for the futures varieties mentioned. Market risk, the investment need to be cautious.

This article is derived from industry information